Companies that Care: The Curchin Group named a “Champion of Good Works” by the Commerce and Industry Association of New Jersey (CIANJ) for Second Year in a RowApril 19, 2018

The Curchin Group was named a “Champion of Good Works” by the Commerce and Industry Association of New Jersey (CIANJ) at its Fifth Annual Chairman’s Reception, honoring the philanthropic efforts of the local business community. The Curchin Group was recognized in the “Supporting New Jersey Charities” category along with five other organizations. With over …

Tax Cuts and Jobs Act of 2017: What You Need to KnowFebruary 15, 2018

By: Edward Rigby, CPA Most of the new tax law went into effect January 1, 2018, impacting business owners and individuals for the 2018 tax year. This article focuses on educating our clients and helping them understand how the changes will affect them and their tax services. Here are the key provisions: Major Corporate Tax …

Business Valuation for Owner DisputesFebruary 13, 2018

By: Roy Kvalo, CPA/ABV/CFF, CVA When two or more business owners are embroiled in conflict, a valuation can pave the way to a resolution. Specializing in business valuation and litigation, The Curchin Group has helped resolve this type of situation many times and can offer a bit of insight that might be helpful to you …

Tax Reform and 2017 Year-End Tax PlanningDecember 21, 2017

Congress is enacting the biggest tax reform law in thirty years, one that will make fundamental changes in the way you, your family and your business calculate your federal income tax bill, and the amount of federal tax you will pay. Since most of the changes will go into effect next year, there’s still a …

Nov/Dec 2017 NewsletterDecember 19, 2017

The latest issue of the Curchin Newsletter is here! You can look forward to reading about hot topics in accounting/tax/audit, firm news, and more! In this issue: 12th Annual Curchin Open recap, Guide to Charitable Contributions, Year End Tax Planning, Featured Employee: Richard Presser, Firm News & Photos. Read More

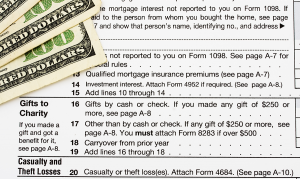

5 Tips for Making Tax-Deductible Charitable DonationsDecember 13, 2017

During the holidays, many people make donations to help those in need. It’s also the last chance in the calendar year to qualify for tax deductions on charitable gifts, adding a sense of urgency to the philanthropy. While any and all charitable giving helps humanity move forward, there are a few best practices to ensure …

New 2017 NJ Tax Exemption for VeteransDecember 11, 2017

Year-End Tax Planning for Individuals and Small BusinessesDecember 8, 2017

Don’t look now, but the 2018 tax season is just around the corner. Year-end tax planning can reduce both your tax burden and stress once the filing season arrives. Year-End Tax Planning for Individuals Give to Charity Charitable donations come from the goodness of your heart, not for the tax benefits. With that said, …

The Curchin Group Raises $22,000 For Two Local Charities at the 12th Annual Indoor Mini Golf TournamentNovember 22, 2017

The Curchin Group, LLC, a mid-sized, full-service accounting firm based in Red Bank, N.J., hosted its 12th Annual Curchin Open Miniature Golf Tournament on Wednesday, Nov. 8, 2017 from 4 p.m. to 7 p.m. This year’s donation was the biggest in the history of the event; $22,000 will be awarded to the two chosen …

Key Federal Income Tax Issues Associated With Rentals of Residences and Vacation HomesNovember 9, 2017

This article highlights and explains the key, but somewhat complex, federal income tax rules associated with rentals of residences and vacation homes. The rules discussed include the definition of what constitutes a residence or dwelling, how personal use of the residence by the taxpayer affects the tax treatment, what expenses are deductible against rental income, …